Sustainability is no longer just a communication issue. With the CSRD directive and ESRS standards, sustainability reporting is becoming mandatory—even for many medium-sized companies.

However, the challenge lies not only in reporting, but also in the controllable integration of ESG data into controlling. How can CO₂ emissions, energy consumption, or diversity targets be measured in such a way that they become part of corporate planning?

This is precisely where IBM Planning Analytics (TM1) offers a solution: it enables ESG metrics to be modeled in a structured manner, linked to financial data, and regularly planned or simulated.

Why ESG data is more than just reporting requirements

Many companies still record ESG data in Excel spreadsheets or external tools—separate from financial planning.

This leads to problems:

- Lack of comparability over time,

- duplicate data entry,

- no connection to financial goals,

- high manual effort for audits and reports.

An ESG KPI model creates transparency and controllability here:

It makes sustainability goals measurable and links them to financial reality.

This means that ESG does not become an additional task, but rather part of corporate management.

Which ESG indicators are relevant

The selection of the right metrics depends on the industry and size of the company. ESG KPIs can generally be divided into three dimensions:

- E – Environment: CO₂ emissions (Scope 1–3), energy consumption, water, waste, share of renewable energies.

- S – Social: Employee satisfaction, turnover, training hours, occupational safety.

- G – Governance: Compliance cases, policy implementation, supply chain control.

It is important that each key figure has a clear definition, unit, and source, otherwise it will not be comparable.

ESG data in the Planning Analytics model

With IBM Planning Analytics, an ESG KPI model can be built just as flexibly as a financial planning model. The structure typically follows these steps:

1. Creating a database:

- Identify sources (e.g., energy management, HR system, supplier portal).

- Import data regularly (via ETL or API).

2. Define dimension structure:

- Key figure dimension (CO₂, energy, employees, etc.)

- Organization (location, business unit, plant)

- Time (month, quarter, year)

- Scenario (actual, plan, forecast)

3. Modeling drivers and calculations:

- e.g., CO₂ emissions = energy consumption × emission factor

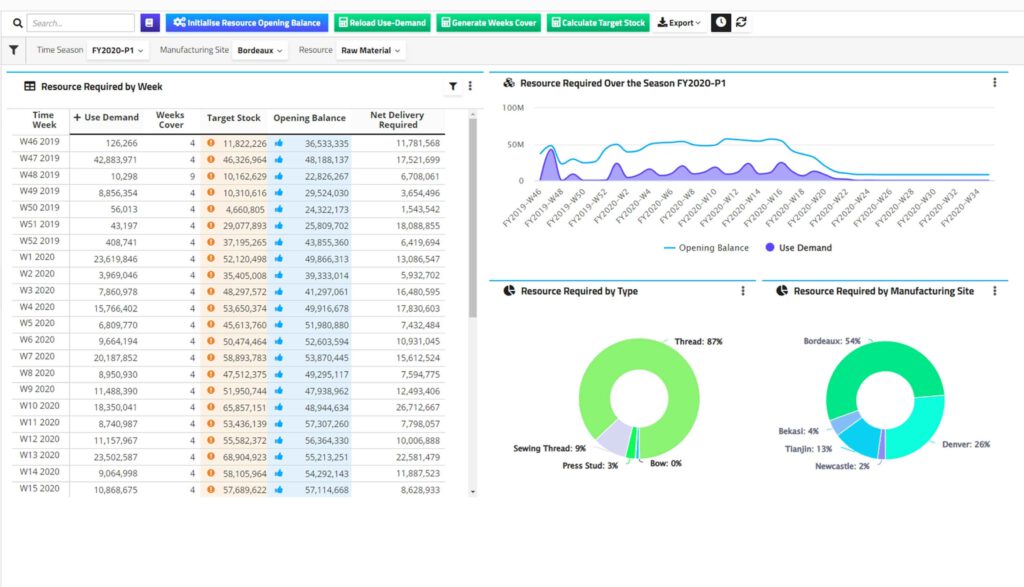

4. Dashboards & Visualization:

- ESG dashboards in Planning Analytics Workspace (PAW)

- Drill down to the source

- Data availability for (automatic) reports for CSRD or internal sustainability reports

5. Governance & Approval:

- Responsibilities (e.g., departments responsible for data maintenance)

- Versioning and audit trails

- Plausibility checks using rules

This creates a model that not only collects ESG data, but also makes it truly controllable.

Practical example

An industrial company wanted to systematically record its CO₂ emissions for the first time and integrate them into its financial planning.

We have:

- Energy consumption imported from SAP,

- emission factors maintained centrally,

- calculation logic stored in TM1,

- and everything displayed in an ESG dashboard.

Result:

Today, management can see how every ton of CO₂ is linked to costs, investments, and targets – and can take targeted action.

Advantages of an integrated ESG KPI model

An ESG model in Planning Analytics creates measurable added value:

- Reliability: a central, auditable database.

- Transparency: ESG data in the same model as financial and planned values.

- Efficiency: less manual work, automated reports.

- Controllability: ESG targets can be simulated and translated into budgets.

- Compliance: CSRD & ESRS requirements are easier to meet.

This means that sustainability is not only reported on, but actively managed.

The next step: AI-supported ESG management

Watsonx.ai will enable ESG data to be used even more intelligently in the future.

Examples from ongoing projects:

- Automated trend analyses (“Which key figures are developing positively?”),

- AI-based emissions forecasts,

- Text generation for ESG reports (automated explanations),

- Data quality checks (outlier detection).

The combination of Planning Analytics and Watsonx.ai enables a new level of sustainability management—transparent, scalable, and verifiable.

Our approach at BI2run

We help companies not only collect ESG data, but also integrate it into their management systems:

- Development of an ESG KPI model in IBM Planning Analytics

- Definition and harmonization of key performance indicators

- Connection of existing systems (SAP, HR, energy, supplier portals)

- Visualization and reporting in PA Workspace

- Optional: Expansion with Watsonx.ai for forecasts and commentary

The result is an ESG solution that is technically sound and professionally comprehensible – by controllers for controllers.

The next step in reporting

Sustainability is measurable—and it belongs in the same system environment as finance and planning.

With an ESG KPI model in IBM Planning Analytics, you can lay the foundation for this: transparent data, traceable goals, and genuine control.

Would you like to integrate sustainability into your planning?

We show you how to use IBM Planning Analytics to build your ESG KPI model and meet CSRD requirements in a practical way.

👉 Request a consultation now – we will work with you to develop your data-driven ESG management system.