Suddenly, the key account asks for CO₂ data. The bank wants information on diversity and social standards. And a public tender requires ESG evidence.

Many small and medium-sized enterprises (SMEs) are experiencing exactly this – without being formally covered by the new EU sustainability reporting (CSRD). But the pressure is increasing: Sustainability information is increasingly becoming an entry ticket to supply chains, financing and public visibility – this is where the VSME standard comes in.

What is the VSME standard?

👉 VSME stands for Voluntary Standard for non-listed Micro, Small and Medium-sized Enterprises.

It was developed by EFRAG, the European institution for financial and sustainability reporting, which is also responsible for the mandatory ESRS (European Sustainability Reporting Standards). The VSME offers SMEs the opportunity to communicate their sustainability performance in a structured, comparable and future-proof manner – voluntarily, but strategically sensible.

How is the VSME standard structured?

The VSME standard consists of two modules that companies can apply depending on their needs and maturity level. The following table shows the differences and content in direct comparison:

Comparison: Basic vs. Comprehensive Module in VSME

| Feature | Basic Module (B1–B11) | Comprehensive Module (C1–C9) |

| Target group | Non-listed micro, small and medium-sized enterprises – especially SMEs, which must comply with ESG requirements without a CSRD obligation | Medium-sized companies with higher stakeholder expectations (e.g. banks, major customers, investors) that require in-depth ESG transparency |

| Function | Entry-level module, minimum requirements | Supplement to the Basic module, for in-depth sustainability presentation |

Contents (disclosures) | B1: Basis for preparation B2: Practices, policies and initiatives B3: Energy and greenhouse gas emissions B4: Pollution B5: Biodiversity B6: Water use and water stress B7: Resource use, circular economy and waste B8: Workforce – general information B9: Health and safety B10: Remuneration, collective bargaining, training B11: Corruption and bribery | C1: Business model and strategy C2: Extended ESG practices and responsibilities C3: Climate targets and transition plans C4: Climate risks C5: Extended workforce disclosures C6: Human rights policy C7: Serious violations of human rights C8: Revenue from critical sectors & EU benchmark exclusion C9: Gender balance in the management body |

| Reporting obligation | No legal obligation – use is voluntary | Also voluntary, but growing pressure from stakeholders |

| Flexibility | Disclosure only if relevant (“if applicable”) | Supplements the relevant points from the Basic Module |

| Typical use case | Initial report, entry into ESG structure | Deepening, stakeholder communication, showing ESG maturity to the outside world |

Application in practice

According to the official VSME process, reporting takes place in several steps:

- Module selection – Basic alone or including Comprehensive?

- Materiality analysis – Which topics are actually relevant for the company? In the VSME, a simplified, qualitative assessment is sufficient, focusing in particular on the impact on the environment and society. Recommendation: Opportunities and risks should also be considered – in a pragmatic form, e.g. with the help of a simple matrix or traffic light logic.

- Data collection & disclosure – on the topics deemed material

- Report preparation – integrated into the annual report or as a separate sustainability document

- Annual update – with updates on material topics and progress monitoring

The modular structure makes it easy to get started – and at the same time offers the opportunity to grow with the requirements.

Materiality analysis in VSME – compact but decisive

A central principle of the VSME standard is: Not everything has to be reported – only what is material.

But what does “material” mean in the context of small and medium-sized enterprises?

What does the VSME require?

In contrast to the ESRS, the VSME does not require a complex double materiality analysis. Instead, the standard focuses on two central perspectives:

- What positive or negative impact does the company have on people and the environment?

- What impact do environmental and social issues have on the company – e.g. on its financial position, performance or liquidity?

This simplified form of materiality assessment allows companies to decide with manageable effort which disclosures are actually relevant – e.g. with the help of simple tables, qualitative assessments or prioritization tools.

Our recommendation for the practice

Even if the VSME formally only requires the impact and financial perspective, Blue Bee Intelligence recommends that risks and opportunities are also consciously included in the assessment – albeit in a lightweight, qualitative form, for example:

| Aspect | Typical questions |

| Effects | Do we have a negative/positive impact on the environment or society? |

| Risks | Which ESG issues could put us at risk (e.g. energy prices, supply bottlenecks)? |

| Opportunities | Where are the strategic benefits of sustainable action? |

The result forms the basis for the selection of the relevant disclosure chapters in the VSME (e.g. B3, B8, C3 etc.)

Materiality in VSME – simple & practical

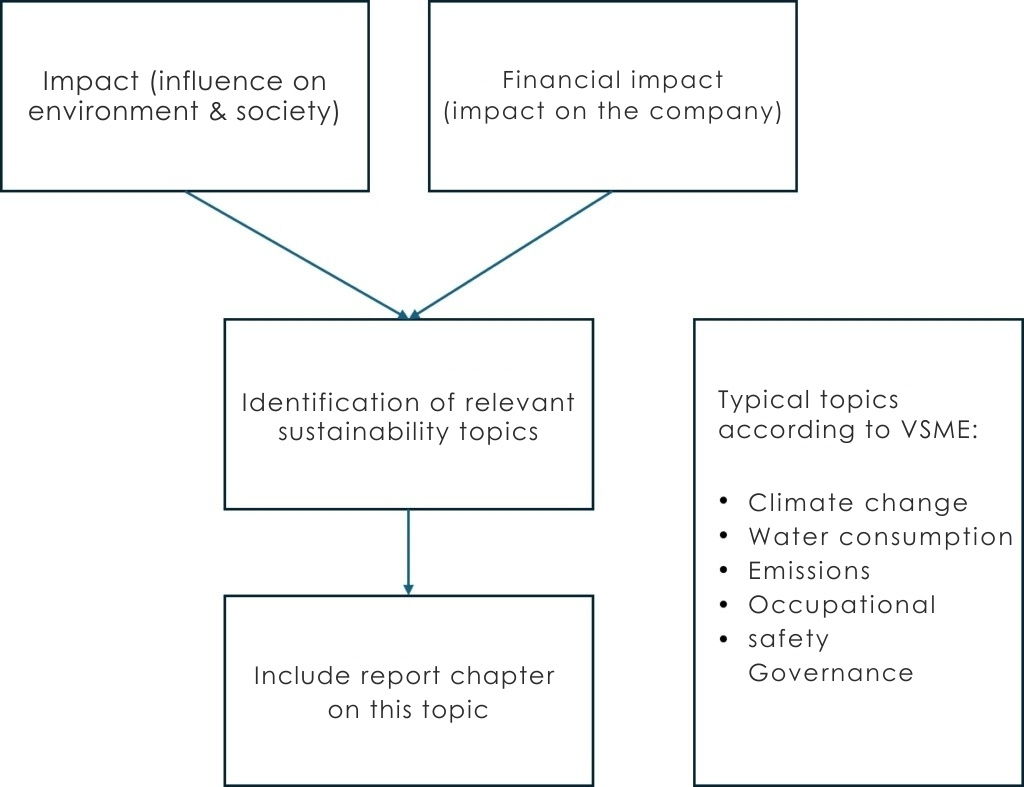

The following diagram shows the simplified decision-making process used by the VSME to determine which topics need to be included in the report – based on two parallel evaluation directions:

The 3 biggest advantages of the VSME

1. structure instead of excessive demands

The VSME standard provides a clear, structured framework for recording and communicating ESG issues – without bureaucratic overload.

Especially in comparison to the more than 1,000 pages of the ESRS (CSRD standards), the VSME is a much leaner alternative with around 40 pages of core content – and still connectable.

In concrete terms, this means:

- 11 disclosure topics in the Basic Module (instead of >80 in ESRS)

- 1 day for an initial materiality assessment (instead of days for double materiality analysis)

- Recording in a simple Excel template possible

- No obligation to conduct stakeholder surveys, no obligation for monetary quantification

Use Case:

A medium-sized company with 65 employees in the metalworking industry decides to get started with sustainability – with the VSME Basic module. It chooses only the Basic Module and classifies 5 out of 11 topics as material (e.g. energy consumption, occupational safety, equality).

For the initial data collection, the company primarily draws on existing information. A lot of data is already available – for example from previous ISO certifications or from documents for the bank.

→ Result: An ESG framework report is created in <1 week with realistic effort – without external consulting obligation.

2. Protection against ESG pressure – the shielding effect

More and more SMEs are experiencing ESG requirements not through legislation, but through market mechanisms:

Major customers are subject to the CSRD, banks are incorporating ESG criteria into lending decisions and public sector clients are demanding sustainability certificates. These requirements often come suddenly, without context and with deadlines.

A key feature of the VSME standard is its “shielding” effect:

Anyone who reports in accordance with VSME automatically fulfills many of the ESG data requirements that are currently imposed by banks, customers, investors or the public sector.

What does shielding mean in VSME?

Instead of writing a separate ESG report for each stakeholder, companies can cover all relevant information requirements with a standardized VSME report.

This means:

- No duplicate data queries

- No Excel flood for individual requests

- No uncertainty as to which ESG framework is currently in demand

Why this is crucial:

| Previously (without VSME) | Today (with VSME) |

| Customer A asks about energy emissions | → Are included in B3 |

| Bank B wants diversity key figures | → B8-B10 cover this |

| Investor C wants Governance & Anti-Korruption | → B11, C8 & C9 provide the basis |

| Public sector requires environmental report | → Combination of B3-B7 available |

VSME creates a uniform ESG standard that works for several addressees at the same time.

3. Future-proof through connectivity

The VSME is not an isolated tool, but has been specifically aligned with the content of the ESRS (CSRD standards). Companies that work with the VSME create an ESG structure that can be further developed at any time – should regulatory requirements increase or stakeholders demand more.

Relevance in the context of the Omnibus Act

With the planned omnibus procedure (spring 2025), the thresholds for the CSRD reporting obligation are expected to be adjusted (raised).

This means for many companies:

- They fall out of the CSRD (again) – or

- they were never directly affected, but still have to provide ESG data (e.g. to customers or banks)

→ In both cases, the VSME is the practicable intermediate format that ensures professionalism without regulatory overhead.

Example:

A company with 320 employees will no longer fall under the CSRD from 2026 due to adjusted thresholds.

Instead of a full ESRS report, it will use the VSME standard from 2026 in order to continue to be able to meet customer and bank requirements in a structured manner – without regulatory pressure, but with a high level of credibility.

VSME = Stability in ESG reporting.

Whether CSRD comes, stays, falls or is adapted – with the VSME, companies remain compliant without having to start from scratch every time a directive changes.

How we support companies with VSME reporting

Whether it’s an initial ESG structure, a standardized sustainability report or internal competence development – with our subsidiary Blue Bee Intelligence, we support small and medium-sized companies through the VSME process with a holistic approach. Our goal: ESG reporting that works, scales and creates trust – without complexity.

Our services at a glance

| Power range | What we do specifically |

| VSME Readiness Check | Analysis of the status quo & assessment of materiality issues |

| Module selection & structuring | Support in the selection of relevant disclosures (basic vs. comprehensive) |

| Data analysis & documentation | Development of simple templates for data collection and ESG documentation |

| Report creation | Support in the preparation of the first VSME-compliant sustainability report |

| Toolkits & checklists | Provision of customizable Excel/Notion tools for self-use or teams |

| Training & knowledge building | Training formats for internal skills development (e.g. for sustainability managers in SMEs) |

For whom is this particularly relevant?

- SMEs that receive ESG inquiries from customers or banks

- Companies that fall outside the CSRD but still want to report professionally

- Companies that want to prepare for regulatory developments at an early stage

- Organizations that want to build internal transparency and ESG knowledge

More and more medium-sized companies are relying on the VSME standard – not because they have to, but because they have understood it:

Sustainability becomes the touchstone of corporate relevance.

“We report voluntarily – because we want to be prepared. Not at some point. But now.”

– Managing director of a mechanical engineering company (140 employees)

What sets us apart:

- Consulting with depth – we know CSRD, VSME & ESG down to the last detail

- Tools with benefits – we don’t deliver PowerPoints, but implementable solutions

- Support with foresight – we think along with you instead of just working through

- Understanding for SMEs – no overengineering, but real feasibility

The VSME standard protects, strengthens and signals: We are ready. Are you too?

Then let us talk. We’ll show you how VSME can work in your company – simply, effectively and precisely.